Massachusetts’ Paid Family and Medical Leave (MA PFML) Frequently Asked Questions

This FAQ is for Massachusetts’ Paid Family and Medical Leave (MA PFML) groups only. Every benefit plan is unique as benefits may differ based on the selections of the benefit plan. It is very important that you reference the specific group policy as it provides detailed plan information relative to the MA PFML for the specific employer.

Applying for Benefits

Q. How can MA PFML claim forms be obtained?

A. MA PFML claim forms can be found online at USAbleLife.com or by calling our Customer Care Center at 800-370-5856.

Q. How does a covered individual file a MA PFML claim?

A. Once the claim form is completed, you can submit that information and any attachments by fax, email, or mail to:

- Attention: Claims Department

- Mail: P.O. Box 1650 | Little Rock, AR 72203

- Email: claims@usablelife.com

- Online: USAblelife.com/claims

- Fax: (501) 235-8417

The Covered Individual section and Employer Statement section can also be filed online via usablife.com through an online claim form.”

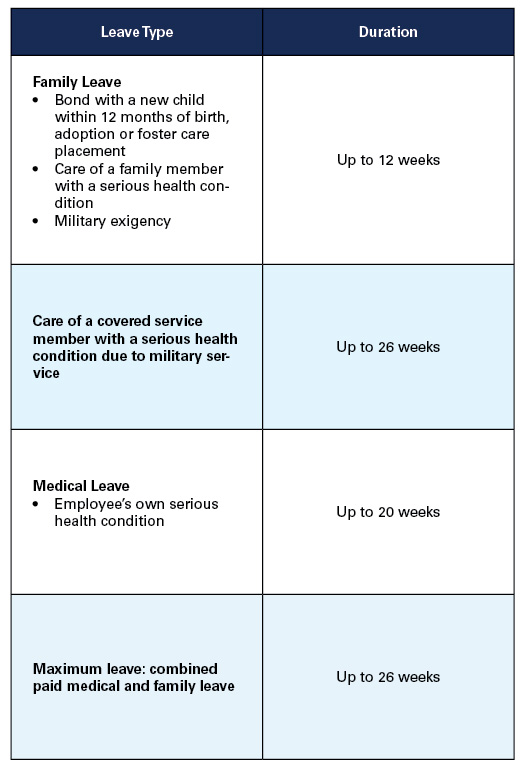

Q. How many weeks are available for paid family or medical leave in a benefit year?

A.

Q. What is a benefit year?

A. The benefit year is the period of 52 consecutive weeks beginning the Sunday immediately preceding the first day leave begins. As such, it is a rolling year and not a calendar year.

Q. When should a covered individual file a MA PFML claim?

A. Medical Leave claims should be submitted as soon as a serious health condition occurs to ensure a claim decision is made timely.

Family Leave claims should be submitted as soon as the leave for bonding with a new child (newborn, adoption, or foster), care for a sick family member with an illness or injury due to military service, military exigency, or care for a family member with a serious health condition starts to ensure a claim decision is made in a timely manner.

If you or a family member have a planned surgery, delivery, or leave, you should submit your claim no more than 30 days prior to the scheduled event.

It’s important to note that an employee is expected to provide their employer notice of the need for leave at least 30 days in advance of the leave, or as soon as practicable if providing the 30 day notice is not feasible.

Q. What information is needed to file a MA PFML claim?

A. Please refer to the claim form for reference.

Eligibility

Q. Do former employees qualify for MA PFML?

A. Yes, but the following must be met:

- Leave begins within 26 weeks of their termination date

- Employee remains unemployed at the onset of the leave

- Employee meets the financial test requirement

A denial may be rendered if any criteria above is not met. Any new employment would require filing a claim with the state or the employee’s new employer’s MA PFML adjudicator.

Claims Management

Q. What happens after the claim is filed?

A. After a claim is submitted, we will review it to ensure if the claimant is considered a covered individual, determine if the event qualifies for paid leave, assess and document the length of leave that has been certified by a medical provider, determine how much the covered individual will be eligible for, and communicate our decision.

We ask that a complete and accurate claim be submitted, including all required paperwork and any subsequent requests, as this will help with the timely review and decision of the claim.

Q. How will claims for groups with USAble Life STD be handled?

A. For USAble Life Fully Insured STD groups, disability benefits will be integrated with MA PFML for a seamless claims process with a single claims examiner managing both claim experiences. All attempts will be made to use information from either claim to make claims decisions.

If we receive an STD claim not accompanied by a Medical Leave claim, we will initiate the medical leave proactively and determine if additional information will be required for a claim decision. The same rule will apply if we receive a Medical Leave claim for an individual also enrolled in STD with USAble Life.

If a covered individual chooses to withdraw their claim, whether filed by them or proactively filed by our claims team, they have the right to do so.

Q. Is someone assigned to my claim?

A. Yes. All claims are reviewed for completeness and assigned to a dedicated claims examiner. Your claims professional will manage your claim from start to finish, coordinating efforts to resolve your claim quickly and efficiently.

Q. Whom should I contact to check the status of my claim?

A. Our Customer Care team is happy to check your claim status for you. Call at your convenience, Monday through Friday, 8 a.m. to 5 p.m. CST at 800-370-5856, or email custserv@usablelife.com. We’re standing by, ready to help!

Q. How long does it take a decision to be made on a MA PFML claim?

A. USAble Life strives to make the initial decision on a paid family or medical leave claim within five business days after receiving all information needed. Each claim is different, and we may request additional information to make a decision on a claim. By way of the Massachusetts statute, a decision must be made no later than 14 days.

Q. What is the benefit waiting period?

A. The number of days a covered individual must wait before benefits become payable. No benefits are payable during the waiting period. Because we do not pay for the waiting period, the covered individual may receive other forms of income from their employer during that time, which will not impact their eligibility for MA PFML.

Please be aware that any days in the waiting period that align with a covered individual’s normal work schedule will count against their leave allocation.

Q. Does the MA PFML calendar ever stop?

A. Payments for leave are based on the covered individual’s work schedule, the covered employer’s holiday and break calendar, and the covered employer’s policy on payment for holidays and breaks.

- If the covered employer provides pay for holidays while the covered employee is on leave, MA PFML will not be paid and those days will not count against the benefit year leave allocation.

- If the covered employer does not provide pay for holidays while the covered employee is on leave, MA PFML will be paid and those days will count against the benefit year leave allocation. The only exception is if the covered individual is on intermittent leave and the holiday falls on a day that they are not expected to work. In this instance, MA PFML will not be paid, and those days will not count against the benefit year leave allocation.

- If the covered employer provides pay for breaks (seasonal shutdowns, summer breaks, etc.), regardless of leave status, to all employees, MA PFML will not be paid, and those days will not count against the benefit year leave allocation.

- If the covered employer does not provide pay for breaks (seasonal shutdowns, summer breaks, etc.), regardless of leave status, for all employees, MA PFML will not be paid, and those days will not count against the benefit year leave allocation.

- If the covered employer does provide pay for breaks to all employees except those on a leave, MA PFML will be paid and those days will count against the benefit year leave allocation.

Both days and total hours are captured in order to determine used and unused time. If an individual is taking time intermittently, only leave hours used will count against the benefit year leave allocation.

Covered individuals can use the paid leave they qualify for at any time in the year after their leave starts, provided the time is certified. But if they don’t use it all within the benefit year, unused time will not carry over into the next benefit year. They can apply again for paid leave in the following year if they have another qualifying event.

Q. If a covered individual uses MA PFML intermittently without exhausting their benefit year allocation, do they still need to wait another year before they can use it?

A. No. As long as the covered individual has not used their leave allotment for the benefit year, they can still file a new claim during the benefit year. An employee will be required to meet another waiting period if, at the end of a leave, they are transitioning to another type of leave. This requirement does not apply to a medical leave for pregnancy immediately followed by family leave.

Please keep in mind that intermittent leave specifically for bonding must be approved by the employer.

Q. If a covered individual receives leave from a company sponsored leave program, can they defer utilization of MA PFML?

A. No. Leave taken through another employer leave program for the covered employer will run concurrently with MA PFML and counts towards the covered individual’s MA PFML leave allocation.

Q. What happens if I experience more than one qualifying event in the same year?

A. You may qualify for up to 26 weeks of leave if you experience both a family event and a serious health condition event in the same benefit year. A qualified medical provider must certify how much leave is medically necessary for each qualifying event (with the exception of Military exigency and Child Bonding).

Q. Who should notify us of return to work?

A. The covered individual should notify USAble Life as soon as they plan to return to work. The employer should notify USAble Life as soon as the covered individual has returned to work.

Q. Is the leave determination based on certification from a health care provider?

A. Yes. Certification is required from a qualified health care provider/treating physician for medically-related leaves. For PFML claims, we will rely on the certification of the provider to determine the period of approved leave . While PFML and STD claims often run concurrently, it’s important to note that certification guidelines for STD may vary from those used for PFML. This may include needing additional information and using medical durational guidance to make an STD claim determination. Each claim will be reviewed on its own merits regardless of diagnosis.

The only leave types that do not require certification from a health care provider are Military exigency & Child Bonding. For Child Bonding, acceptable documentation, such as a birth certificate, adoption decree or court order, must be submitted to substantiate the leave.

Q. Could a certification form from a concurrent leave (MA Parental Leave or FMLA) be used for the MA PFML claim?

A. Yes. For convenience to the covered individual, we will accept these certifications if they adequately provide the same information needed for your MA PFML claim. We will be required to request additional information if it does not comply with our requirements.

Q. How often should intermittent time be reported?

A. Whether a covered individual has an established or irregular intermittent schedule, it is suggested that time be reported at least on a weekly basis if applicable. Based on the nature of the leave, we will work closely with the covered individual and employer to address reasonable reporting requirements.

Q. What happens if a leave has been approved through a certain period but additional time is needed?

A. A covered individual must submit a request for an extension that specifies the desired extension period and include additional certification from a health care provider as part of that request.

Q. Is cosmetic treatment considered a serious health condition?

A. Cosmetic treatments are not considered serious health conditions, unless inpatient hospital care is required or complications develop. We will only consider the period of hospitalization or the recovery period post complications, as applicable leave.

Q. Is a covered individual required to share medical information regarding the MA PFML claim with the employer/policyholder?

A. No. You are not required to share any medical information with your employer. USAble Life will use information received from your or your family member’s health care provider to assess how much time you need to take off to care for yourself or a family member.

When you apply for MA PFML, your employer will receive communication from us detailing the date you applied, the expected start and end dates of your MA PFML, and the date you indicated you provided them notice (if necessary). Your employer will also receive a letter once a decision has been made on your claim. This letter will not include personal medical information.

Q. If a covered individual has concurrent STD and MA PFML claims, will decisions be made at the same time?

A. No. Because these products have different eligibility, coverage, and benefit determinations, decisions (and payments) will not always be aligned.

Communication

Q. Upon receipt of a new claim or claim extension, when will the covered individual and employer be made aware of receipt?

A. We will communicate to the covered individual or employer no later than five business days acknowledging the claim or extension request and advising if additional information is needed for a claim decision. If additional information is needed, our requests will be accompanied by an acknowledgment phone call.

Q. If additional information is needed, how much time will a covered individual have to respond?

A. Requested forms and/or certifications should be provided within 15 days of initial requests. We will work closely with the covered individual to expedite our communications by sending information by email if authorized.

Although some claim information requested may be needed from sources other than the covered individual, it is still the responsibility of the covered individual to coordinate (and pay for in some cases) the return of said information. We will proactively request information for key sources if contact information is available for us to do so.

If there is a concurrent STD claim, we will attempt to align our requests for information to avoid redundancy and confusion.

Q. How will decisions be communicated?

A. Approvals, denials, and extensions will be communicated by letter and accompanied by a phone call. Approvals and extensions will detail the type of leave approved and the time period supported. If a leave is denied, our letter will detail the reason for denial and outline the covered individual’s right to appeal.

Payments

Q. How much will my MA PFML benefits be?

A. The benefit percentage is based on the state’s average weekly wage and a covered individual’s own qualified earnings. Benefits will be calculated per the below:

- If the covered individual’s average weekly wage is less than or equal to 50% of the state’s current average weekly wage, they will be paid at a rate of 80% of their average weekly wage.

- If the covered individual’s average weekly wage is greater than 50% of the state’s current average weekly wage, they will be paid 80% of 50% of the state’s current average weekly wage plus 50% of the covered individual’s average weekly wage that is greater than 50% of the state’s current average weekly wage.

- Payments will not exceed the maximum allowed by the certificate.

The state’s average weekly wage that will be used to calculate benefits as of Jan.1, 2026, is $1,922.48. The state maximum as of Jan.1, 2026, is $1,230.39 per week, but please refer to your certificate to determine the maximum applicable to your group.

Keep in mind that the state maximum and average weekly wage will be reevaluated in October of each year and, therefore, are subject to change annually.

The benefit may be reduced by other income benefits the covered individual is entitled to receive. Refer to the group certificate for details.

Q. When do payments start?

A. Payments will begin within 14 days of approval. If a decision has been made in advance of the start of the actual leave, payment will be made upon the onset of the leave.

Q. When will you receive your benefits?

A. Benefits are issued on a weekly basis. Under certain serious health conditions, we may choose to pay benefits as an advanced lump sum payment (Express Pay).

Q. How will a covered individual receive benefits?

A. Disability and PFML benefit payments are made through Direct Deposit, Direct to Debit, Pay Pal, Venmo and Check. Once a claim is approved, the member will have an option to select their payment method providing they have a valid cell phone number and email address.

Q. If a covered individual has both a MA PFML and an STD claim with USAble Life, will they receive one payment for both claims?

A. No. For appropriate record-keeping, we will be making separate payments for each claim type.

Q. What if a covered individual is overpaid/underpaid benefits?

A. We will review the claim payments/file to determine the reason for an overpayment/underpayment, calculate the amount, and communicate this to the covered individual. If an underpayment, the payment will be issued to the covered individual. If an overpayment, we will work with the covered individual to establish an appropriate recovery plan to ensure the overpayment is resolved.

Benefit Reduction

Q. Are there any direct (dollar for dollar) reductions to MA PFML?

A. Yes. As outlined by the Department of Family and Medical Leave, MA PFML may be reduced by any income received from wages, any government program or law, or under other state or federal temporary or permanent disability benefits law, or a permanent disability policy or program of an employer. Please also refer to your certificate.

Q. Can a covered individual receive other forms of income from their employer?

A. Yes. If the aggregate amounts of MA PFML benefits and STD, Accrued Leave (PTO, sick leave, vacations, salary continuation, etc.), and another paid medical/leave program with the employer don’t exceed the covered individual’s average weekly wage, these benefits can be received concurrently with no penalty. Only the excess will be considered a reduction. As such, we will need to know the amount being received and period represented to accurately assess the amount due.

Q. Does the Employer qualify for reimbursement if they pay the employee from an employer sponsored leave program for the same period of the MA PFML claim?

A. All claims received require documentation from the employer on other income they are offering their employee received concurrently with MA PFML. We encourage employers to evaluate their leave programs to determine how these other income benefits align with MA PFML program, to eliminate redundant and/or overlapping payments. In some cases employers will be eligible for reimbursement if they offer payments to a covered individual that matches or is greater than their PFML entitlement under an eligible leave program, excluding accrued leave programs (PTO, accrued sick leave, vacation, donated time, annual leave, personal leave, or comparable leave). The leave type being paid by the employer must match the leave type for which MA PFML is being claimed.

In order to facilitate reimbursement the following must be met:

- USAble Life will need to be provided with formal documentation of the company leave program(s) being exercised that outlines requirements, eligibility, payment standards, etc. at group implementation.

- The employer will need to provide proof of payment including type of payment, amount of payment, duration of payment, and time period being covered by way of payroll records or other formal payment documentation (normal process for reporting other income).

- A formal request for reimbursement must be made by the employer be at time of claim

Once reviewed, we will determine if the benefit amount due to the covered individual and if reimbursement is required. All payments to the employer and covered individual will be issued shortly after the decision.

Q. If a covered individual has an STD claim with USAble Life and a concurrent Medical Leave claim adjudicated by USAble Life, the state, or another carrier, how will reductions be handled?

A. We will apply an estimated reduction to your STD claim to avoid an overpayment to your STD. Once we have determined or are advised of the status of your MA PFML claim (including the amount you may be eligible for), we will reconcile your claim and communicate our decision.

Please review your STD certificate to determine if MA PFML is a reduction.

Appeal Process

Q. If I disagree with a claim decision on my MA PFML claim, what recourse do I have?

A. For any adverse claim decision, a written notice with a detailed explanation of the determination will be provided. The notice will include specific instructions on how to appeal the decision if you do not agree with the findings, the time frame for filing an appeal, and where to send your appeal.

Appeals must be submitted in writing within 15 days of the determination. Although not required, claimants may use the [appeal form](APPEAL FORM-USAL (8-16)) located in the Document Center for a MA PFML appeal.

The appeal process will include a new, comprehensive review of all documents and a determination by an individual who did not make the first claim decision. Appeal decisions are made within 45-60 days.

If the decision is upheld, or you disagree with the outcome of your appeal, you may file a second appeal directly with the Department of Family and Medical Leave.

Taxability

The below information reflects USAble Life’s understanding of the current tax law related to benefits payable under its Paid Family and Medical Leave insurance policies and does not constitute, nor does USAble Life provide, tax advice. The employer and/or any covered individual should always seek the advice of their tax advisors regarding the employer and/or covered individual’s specific circumstances.

Q. Are Paid Medical Leave benefits taxable?

A. Paid Medical Leave benefits are those paid for leave related to the personal accident and/or health of the covered individual due to a serious health condition. These benefits will be treated as Third-Party Sick Pay (IRS Publication 15-A) and will be taxable when:

- The employer pays any portion of the premium

- The covered individual pays any portion of the premium with pre-tax dollars

Reviewing the ratio of such premium to the total premium determines taxable benefits.

When the covered individual pays any portion of the premium with after-tax dollars, we review the ratio of such premium to total premium to determine nontaxable benefits.

Q. What taxes are applicable for taxable Paid Medical Leave benefits?

A. Benefits may be subject to Federal and State income taxes as well as Social Security and Medicare Taxes (FICA taxes), and Federal and State Unemployment taxes. Applicable covered individual’s Social Security and Medicare Taxes (FICA Taxes) are withheld at current rates on any taxable benefits. Applicable employer matching FICA Taxes, as well as any unemployment taxes, are the responsibility of the employer and will be due as we report the taxable benefits to the employer throughout the year. Federal Income Tax is withheld only at the covered individual’s request (via submission of Form W-4S).

Q. How will taxable Paid Medical Leave benefits be reported at year-end?

A. We will report to the employer total Paid Medical Leave benefits on or before January 15 of the following year.

Please be reminded that it is the employer’s responsibility to prepare and provide to covered individuals Form(s) W-2 that include these benefits.

The employer may request that we prepare Forms W-2 on their behalf at no charge. The employer must submit an STD and MA PFML W-2 Agreement requesting that we provide this service. If the employer uses a payroll service, they should discuss W-2 responsibilities with them prior to submitting any W-2 Agreement. Most service organizations require that they prepare the forms.

If USAble Life completes Form(s) W-2, the employer may be required to file Form 8922 with the IRS that aggregates all Third-Party Sick Pay (including STD, Paid Medical Leave, etc.), for which the employer is not the preparer of Form(s) W-2, in order to reconcile the sick pay on their quarterly federal payroll filings (Form(s) 941).

Q. Why wasn’t FICA tax withheld (or why was partial FICA tax withheld)?

A. Please refer to IRS Publication 15-A; FICA taxes do not apply to certain payments, including the following:

- Six-month rule – According to the IRS, FICA tax withholding is no longer required starting from the sixth month after the month in which the employee’s absence from work began. However, these payments may still be subject to other state or federal employment taxes.

- Social Security earnings cap – Every year, the IRS establishes a wage threshold dictating that Social Security no longer be withheld once someone has reached that amount. In 2026, this amount is $184,500. The Social Security earnings cap starts over at the beginning of each year.

Q. What should groups use to file their taxes?

A. Our tax reporting analyst sends bi-weekly and quarterly reports to every group, which details all the information a group needs to file their taxes. Any questions can be sent to the provided reporting email.

Q. Who to contact with reporting questions?

A. Additional questions can be directed to disabilitytaxreporting@usablelife.com.

Q. Are Paid Family Leave benefits taxable?

A. Paid Family Leave benefits are those benefits paid under the policy other than Paid Medical Leave benefits (see above). These benefits will be treated as taxable income for federal and state purposes, and we will issue Form 1099-Misc to each claimant that has received total Paid Family Leave benefits of $600 or more during any calendar year. USAble Life will not withhold income tax from these benefits.

To ensure accurate and timely reporting of this information to the IRS and to each covered individual, the employer must provide the Legal Name and Taxpayer Identification Number for each covered individual that receives Paid Family Leave Benefits.

Questions?

If you have other general questions, please contact Customer Care at 800-370-5856. Please note we cannot answer hypothetical claim questions. If a claim has been filed, you should call the assigned examiner.